Portugal has entered 'boom and bust' territory as the sharp declines in property prices triggered by the 2008 economic crisis have been replaced with significant increases.

Portugal has entered 'boom and bust' territory as the sharp declines in property prices triggered by the 2008 economic crisis have been replaced with significant increases.

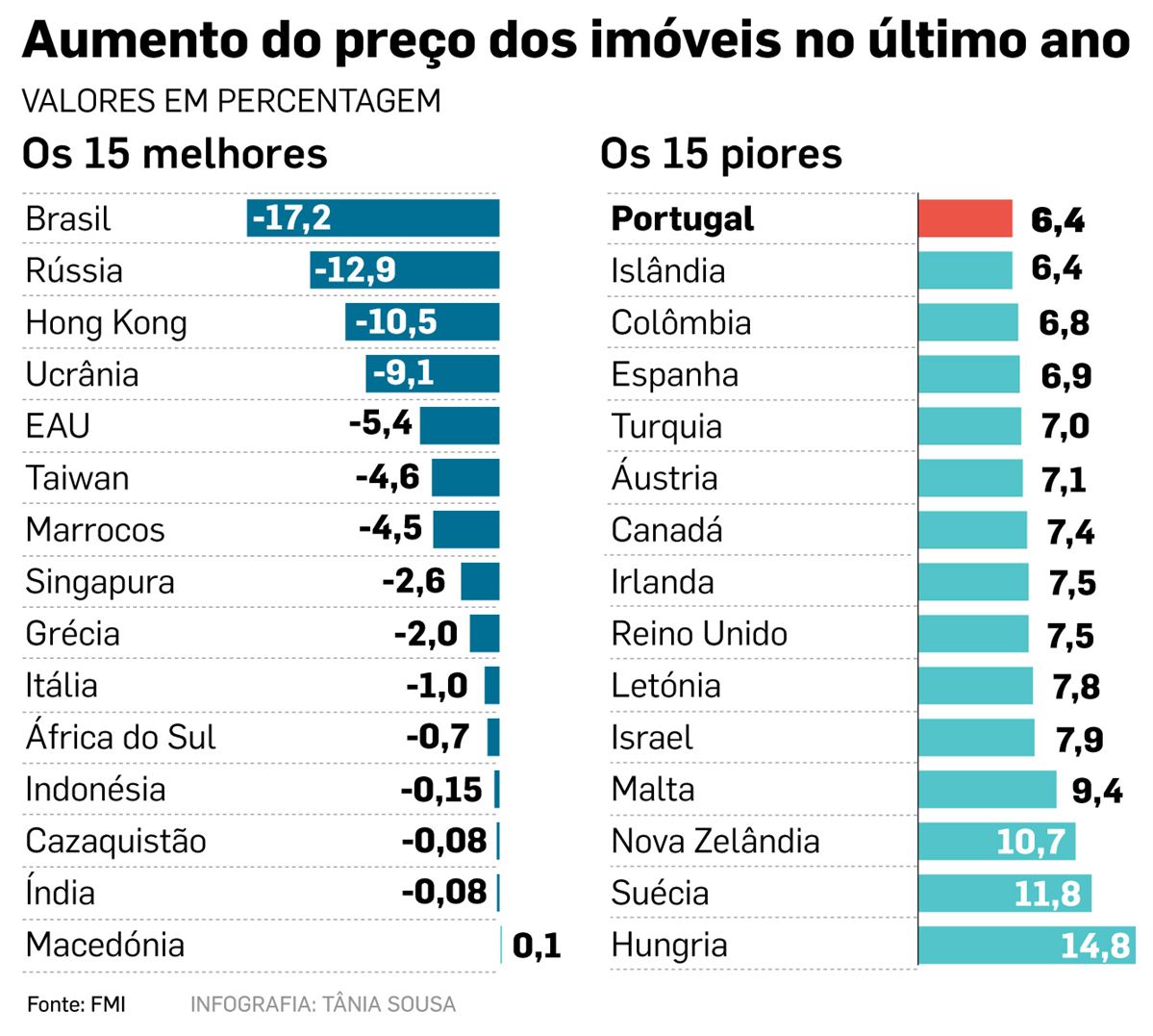

The IMF economists stress that it is not yet time to panic, but to keep an eye on property price levels with Portugal recording the 15th highest annual increase among more than 60 countries analysed.

Real estate prices in several countries are accelerating to pre-crisis levels, according to the IMF study released last week.

"Real estate prices collapsed between 2007 and 2008, marking the beginning of the crisis. Now the IMF housing price index shows that we are almost back at pre-crisis prices," said Hites Ahir and Prakash Loungani at the IMF.

Looking at the prices and market conditions of dozens of countries, the time has come to tighten surveillance to avoid the mistake of saying "this time is different," warn the economists, explaining why it is still not 'panic time' as price rises are not synchronized in all countries and cities, unlike in pre-crisis times, and today there is some regulation to counteract these property bubbles.

According to the data, real estate in Portugal rose in value by 6.4% the last 12 months, the 15th highest in the countries analyzed. This has happened despite a lack of mortgage availability in Portugal and a lack of any average earnings increase.

But the lack of credit in countries like Portugal is another reason for IMF officials to recommend "vigilance."

"Many of the real estate booms have been fuelled by an over-supply of credit," warn Ahir and Loungani.

This time the trigger has been a lack of supply, "Licenses for new housing have grown in number only modestly ... and the impact of supply constraints is evident in several cities," says the IMF.

"Even if prices rise solely because of supply constraint, the impact on household indebtedness may affect financial stability."

The rise in prices is not being matched by household incomes in Portugal, it’s foreign investors pushing prices up meaning Portuguese buyers have to spend more of their income to secure a property.

The IMF economists' analysis comes after the European Council for Systemic Risk (ESRB) also has pointed to the housing market as a potential problem area. The ESRB issued alerts to eight euro countries for identifying the same "medium-term real estate vulnerability" that could have a systemic impact on the stability of the region.

The former president of Portugal’s stock market regulator, Carlos Tavares, also recently warned of "excessive real estate prices."