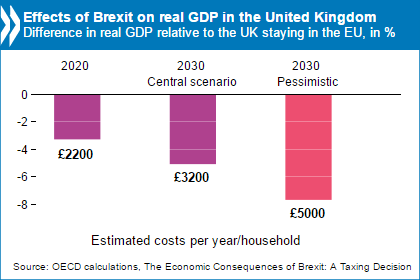

A UK exit from the EU would immediately hit confidence and raise uncertainty which would result in GDP being 3% lower by 2020, which equates to GBP 2200 per household. An OECD report released this morning states that such costs are already piling up.

A UK exit from the EU would immediately hit confidence and raise uncertainty which would result in GDP being 3% lower by 2020, which equates to GBP 2200 per household. An OECD report released this morning states that such costs are already piling up.

The projected hit to living standards would amount in effect to a permanent ‘Brexit tax’ on households, the OECD says.

Presenting the analysis in a speech at the London School of Economics, OECD Secretary-General Angel Gurría said, “Leaving Europe would impose a Brexit tax on generations to come. Instead of funding public services, this tax would be a pure deadweight loss, with no economic benefit.”

The UK would suffer from the loss of unrestricted access to the Single Market. It would also face new barriers in many of the third-country markets to which preferential access was lost as a result of leaving the EU, even if it succeeded in negotiating a new trade arrangement with Europe. An important risk is that capital inflows would be disrupted, leading to a jarring contraction of the UK’s record-high current account deficit of 7% of GDP.

A decision by Britain to leave the European Union would cause a severe negative shock to the economy and weaken GDP growth for many years, equivalent to a cost per household of GBP 3200 per year by 2030 at today’s prices, and as much as GBP 5000 in the worst case scenario according the new OECD study.

Being outside the EU would further damage trade, foreign direct investment and productivity, according to the study.

The longer-term effects of weaker technical progress, migration and capital caused by Brexit are projected according to three scenarios: optimistic, central and pessimistic. In the optimistic projection the negative impact on GDP is around 2.7% by 2030, but in the pessimistic scenario it would be more than 7.5%. In the central scenario UK GDP would be more than 5% below what would be expected if the country remained in the EU. This GDP shortfall is equivalent to GBP 3200 per household.

Net transfers to the EU budget are relatively small, at 0.3% - 0.4% of GDP per annum in the years ahead, and the saving from a reduction in these transfers would be more than offset by the impact of slower GDP growth on the fiscal position. It is estimated that by 2019 the budget deficit would be higher by 0.9 percentage points of GDP.

The study also notes that the estimated costs of Brexit do not take into account the fact that remaining in the EU could lead to additional GDP growth as further development of the Single Market boosts trade and foreign direct investment.

More information on The Economic Consequences of Brexit: A Taxing Decision is available at:

www.oecd.org/economy/the-economic-consequences-of-brexit-a-taxing-decision.htm.

The full PDF of the report also is available: click here

The FT’s Chris Giles and Emily Cadman report on a poll of ‘leading thinkers’ who are united in believing that leaving the EU is bad for the UK’s economic prospects.

In the FT’s annual poll of more than 100 leading thinkers, not one thought a vote for Brexit would enhance UK growth in 2016.

Almost three-quarters thought leaving the EU would damage the country’s medium-term outlook, nine times more than the 8% who thought the country would benefit from leaving. Less than 18% thought it would make little difference.

Many feared the consequences for financial markets would be severe. Don Smith, deputy chief investment officer at Brown Shipley, said:

“The uncertainty generated by a decision to leave the EU would undoubtedly be damaging for sterling assets across the board and, indeed, the value of sterling on foreign exchanges. Consumer confidence would be lower, business confidence and investment intentions would also very likely be negatively impacted.”

The full FT article is available on this link: http://www.ft.com/cms/s/0/1a86ab36-afbe-11e5-b955-1a1d298b6250.html#ixzz476AujswG